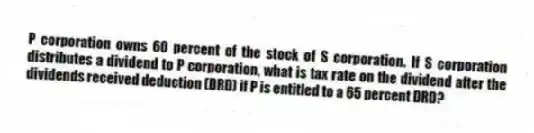

P corporation owns 60 percent of the stock of S corporation. If S corporation distributes a dividend to P corporation, what is tax rate on the dividend after the dividends received deduction (DRD) if P is entitled to a 65 percent DRD?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Assume you plan to start a new

Q65: From a tax perspective, which entity choice

Q66: From a tax perspective, which entity choice

Q68: If you were seeking an entity with

Q76: What is the tax impact to a

Q76: Stacy would like to have SST (a

Q76: Owners of which of the following entity

Q79: David would like to organize HOS (a

Q79: Which of the following statements is True

Q80: Jorge is a 60 percent owner of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents