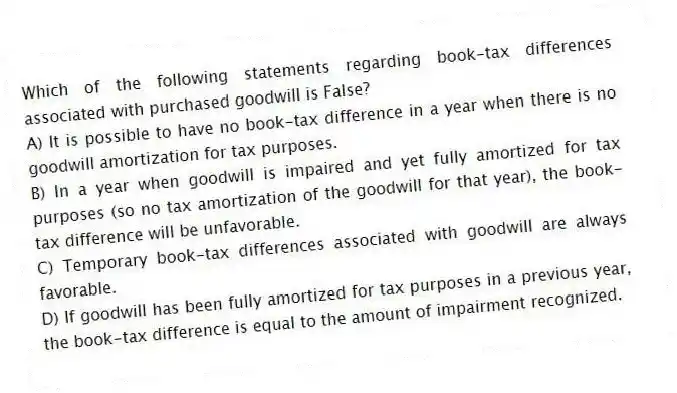

Which of the following statements regarding book-tax differences associated with purchased goodwill is False?

A) It is possible to have no book-tax difference in a year when there is no goodwill amortization for tax purposes.

B) In a year when goodwill is impaired and yet fully amortized for tax purposes (so no tax amortization of the goodwill for that year) , the book-tax difference will be unfavorable.

C) Temporary book-tax differences associated with goodwill are always favorable.

D) If goodwill has been fully amortized for tax purposes in a previous year, the book-tax difference is equal to the amount of impairment recognized.

Correct Answer:

Verified

Q48: Over what time period do corporations amortize

Q52: Which of the following does NOT create

Q52: Which of the following statements regarding nonqualified

Q57: Corporation A receives a dividend from Corporation

Q58: Corporation A receives a dividend from Corporation

Q59: Which of the following describes the correct

Q59: Which of the following statements regarding book-tax

Q59: Which of the following is not calculated

Q62: Which of the following is deductible in

Q62: Which of the following statements regarding excess

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents