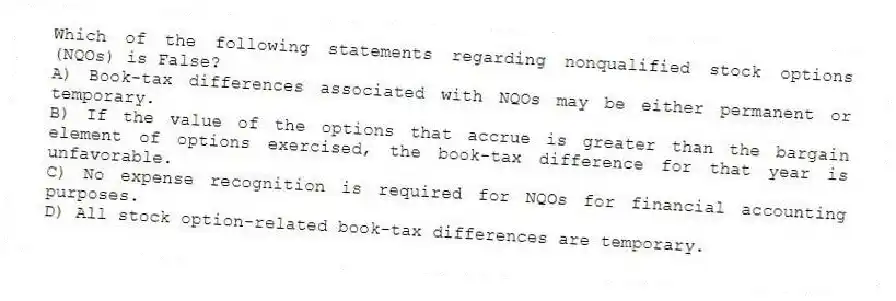

Which of the following statements regarding nonqualified stock options (NQOs) is False?

A) Book-tax differences associated with NQOs may be either permanent or temporary.

B) If the value of the options that accrue is greater than the bargain element of options exercised, the book-tax difference for that year is unfavorable.

C) No expense recognition is required for NQOs for financial accounting purposes.

D) All stock option-related book-tax differences are temporary.

Correct Answer:

Verified

Q43: It is important to distinguish between temporary

Q47: Minimum tax credits generated by the pre-2018

Q48: Coop Inc. owns 40% of Chicken Inc.,

Q48: Over what time period do corporations amortize

Q52: Which of the following does NOT create

Q55: For estimated tax purposes, a "large" corporation

Q57: TrendSetter Inc. paid $50,000 in premiums for

Q57: Corporation A receives a dividend from Corporation

Q57: Which of the following statements regarding book-tax

Q58: Corporation A receives a dividend from Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents