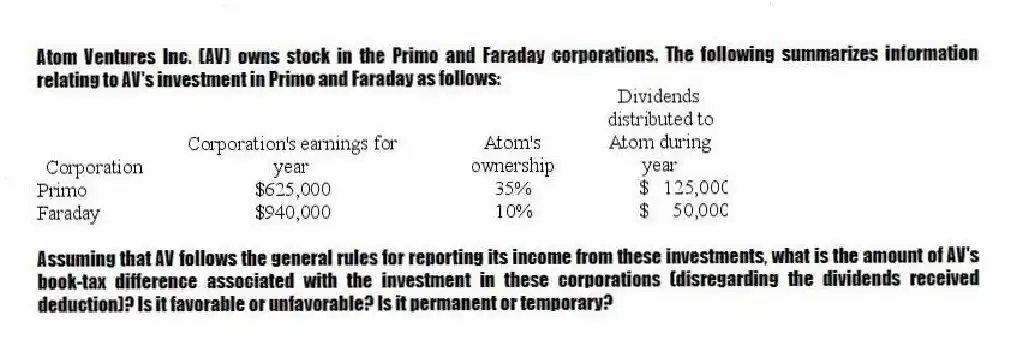

Atom Ventures Inc. (AV) owns stock in the Primo and Faraday corporations. The following summarizes information relating to AV's investment in Primo and Faraday as follows:

Assuming that AV follows the general rules for reporting its income from these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: For book purposes, RadioAircast Inc. reported $15,000

Q87: Which of the following is not an

Q91: On January 1, 2016, Credit Inc. recorded

Q93: Imperial Construction Inc. (IC) issued 100,000 incentive

Q97: In 2018, AutoUSA Inc. received $4,600,000 of

Q98: XPO Corporation has a minimum tax credit

Q99: Rapidpro Inc. had more than $1,000,000 of

Q100: Which of the following statements is False

Q101: In 2018, LuxAir Inc. (LA) has book

Q113: Omnidata uses the annualized income method to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents