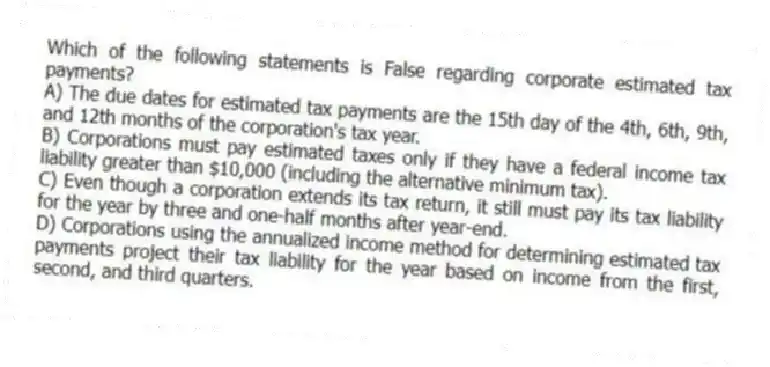

Which of the following statements is False regarding corporate estimated tax payments?

A) The due dates for estimated tax payments are the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's tax year.

B) Corporations must pay estimated taxes only if they have a federal income tax liability greater than $10,000 (including the alternative minimum tax) .

C) Even though a corporation extends its tax return, it still must pay its tax liability for the year by three and one-half months after year-end.

D) Corporations using the annualized income method for determining estimated tax payments project their tax liability for the year based on income from the first, second, and third quarters.

Correct Answer:

Verified

Q87: Which of the following is not an

Q96: Atom Ventures Inc. (AV) owns stock in

Q97: In 2018, AutoUSA Inc. received $4,600,000 of

Q98: XPO Corporation has a minimum tax credit

Q99: Rapidpro Inc. had more than $1,000,000 of

Q101: In 2018, LuxAir Inc. (LA) has book

Q102: Pure Action Cycles Inc., a bicycle manufacturer,

Q103: In 2018, Webtel Corporation donated $50,000 to

Q104: In 2018, Datasoft Inc. received $350,000 in

Q105: Netgate Corporation's gross regular tax liability for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents