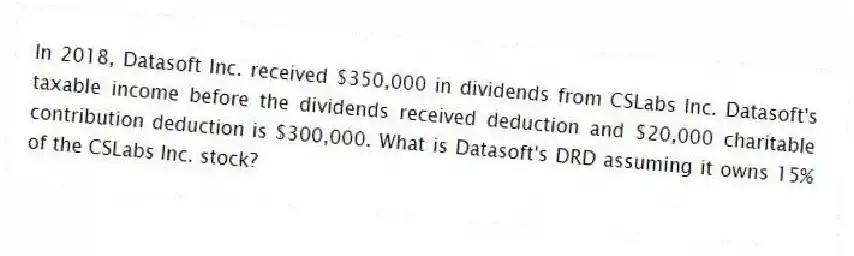

In 2018, Datasoft Inc. received $350,000 in dividends from CSLabs Inc. Datasoft's taxable income before the dividends received deduction and $20,000 charitable contribution deduction is $300,000. What is Datasoft's DRD assuming it owns 15% of the CSLabs Inc. stock?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Rapidpro Inc. had more than $1,000,000 of

Q100: Which of the following statements is False

Q101: In 2018, LuxAir Inc. (LA) has book

Q102: Pure Action Cycles Inc., a bicycle manufacturer,

Q103: In 2018, Webtel Corporation donated $50,000 to

Q103: AB Inc. received a dividend from CD

Q105: Netgate Corporation's gross regular tax liability for

Q107: In the current year, Auto Rent Corporation

Q108: During 2018, Hughes Corporation sold a portfolio

Q129: AR Systems Inc.(AR)had $120,000 of tax liability

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents