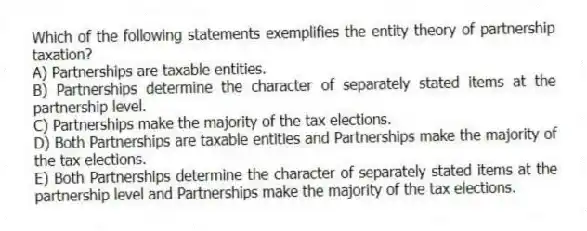

Which of the following statements exemplifies the entity theory of partnership taxation?

A) Partnerships are taxable entities.

B) Partnerships determine the character of separately stated items at the partnership level.

C) Partnerships make the majority of the tax elections.

D) Both Partnerships are taxable entities and Partnerships make the majority of the tax elections.

E) Both Partnerships determine the character of separately stated items at the partnership level and Partnerships make the majority of the tax elections.

Correct Answer:

Verified

Q4: The character of each separately stated item

Q15: Any losses that exceed the tax basis

Q18: Partnerships can use special allocations to shift

Q22: Gerald received a one-third capital and profit

Q23: Which of the following statements is True

Q24: Under general circumstances, debt is allocated from

Q27: Which of the following entities is not

Q28: Which of the following statements regarding capital

Q29: Erica and Brett decide to form their

Q35: A partner can generally apply passive activity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents