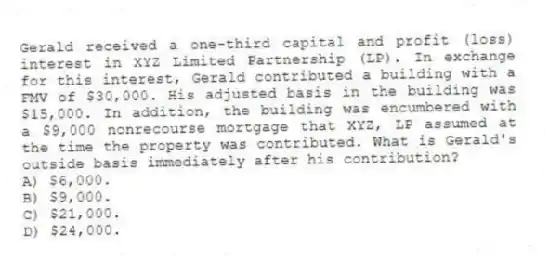

Gerald received a one-third capital and profit (loss) interest in XYZ Limited Partnership (LP) . In exchange for this interest, Gerald contributed a building with a FMV of $30,000. His adjusted basis in the building was $15,000. In addition, the building was encumbered with a $9,000 nonrecourse mortgage that XYZ, LP assumed at the time the property was contributed. What is Gerald's outside basis immediately after his contribution?

A) $6,000.

B) $9,000.

C) $21,000.

D) $24,000.

Correct Answer:

Verified

Q4: The character of each separately stated item

Q7: For partnership tax years ending after December

Q12: A purchased partnership interest has a holding

Q15: Any losses that exceed the tax basis

Q18: Partnerships can use special allocations to shift

Q23: Which of the following statements is True

Q24: Which of the following statements exemplifies the

Q24: Under general circumstances, debt is allocated from

Q27: Which of the following entities is not

Q35: A partner can generally apply passive activity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents