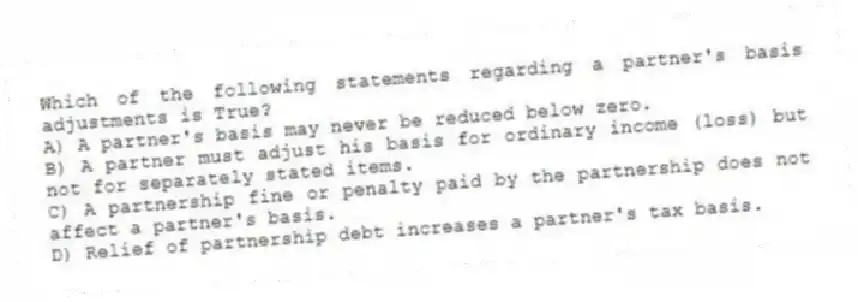

Which of the following statements regarding a partner's basis adjustments is True?

A) A partner's basis may never be reduced below zero.

B) A partner must adjust his basis for ordinary income (loss) but not for separately stated items.

C) A partnership fine or penalty paid by the partnership does not affect a partner's basis.

D) Relief of partnership debt increases a partner's tax basis.

Correct Answer:

Verified

Q71: Does adjusting a partner's basis for tax-exempt

Q71: John, a limited partner of Candy Apple,

Q72: Styling Shoes, LLC filed its 20X8 Form

Q73: How does additional debt or relief of

Q73: What is the difference between the aggregate

Q75: If partnership debt is reduced and a

Q79: Jerry, a partner with 30% capital and

Q80: If a taxpayer sells a passive activity

Q81: Lloyd and Harry, equal partners, form the

Q90: Jay has a tax basis of $14,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents