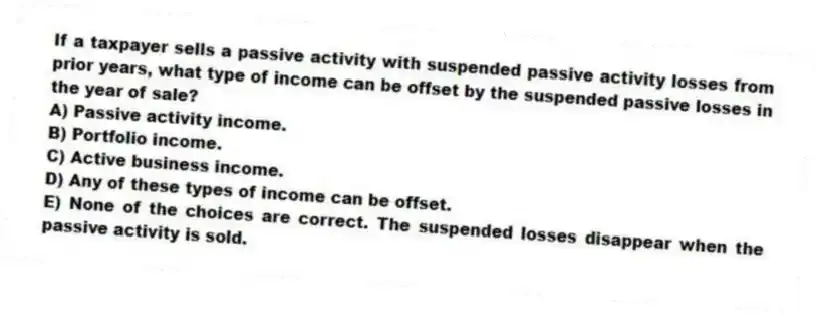

If a taxpayer sells a passive activity with suspended passive activity losses from prior years, what type of income can be offset by the suspended passive losses in the year of sale?

A) Passive activity income.

B) Portfolio income.

C) Active business income.

D) Any of these types of income can be offset.

E) None of the choices are correct. The suspended losses disappear when the passive activity is sold.

Correct Answer:

Verified

Q71: Does adjusting a partner's basis for tax-exempt

Q75: If partnership debt is reduced and a

Q76: Which of the following statements regarding a

Q79: Jerry, a partner with 30% capital and

Q81: Lloyd and Harry, equal partners, form the

Q82: Ruby's tax basis in her partnership interest

Q83: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q84: At the end of year 1, Tony

Q85: J&J, LLC was in its third year

Q90: Jay has a tax basis of $14,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents