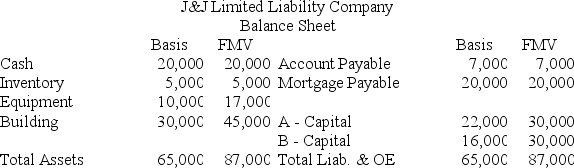

J&J, LLC was in its third year of operations when J&J decided to expand the number of members from two, A & B, with equal profits and capital interests to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a 1/3 capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J when C receives her capital interest? If, instead, member C receives a 1/3 profit interest, what would be the tax consequences to members A, B, and C, and to J&J?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: If a taxpayer sells a passive activity

Q81: Lloyd and Harry, equal partners, form the

Q82: Ruby's tax basis in her partnership interest

Q83: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q84: At the end of year 1, Tony

Q86: On April 18, 20X8, Robert sold his

Q87: Illuminating Light Partnership had the following revenues,

Q88: On June 12, 20X9, Kevin, Chris, and

Q89: This year, Reggie's distributive share from Almonte

Q121: Explain why partners must increase their tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents