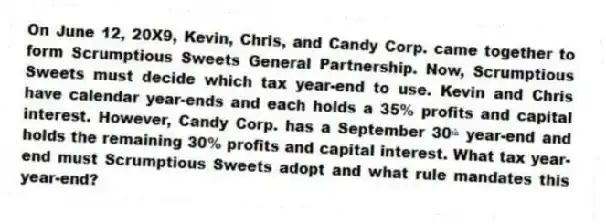

On June 12, 20X9, Kevin, Chris, and Candy Corp. came together to form Scrumptious Sweets General Partnership. Now, Scrumptious Sweets must decide which tax year-end to use. Kevin and Chris have calendar year-ends and each holds a 35% profits and capital interest. However, Candy Corp. has a September 30ᵗʰ year-end and holds the remaining 30% profits and capital interest. What tax year-end must Scrumptious Sweets adopt and what rule mandates this year-end?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q84: At the end of year 1, Tony

Q85: J&J, LLC was in its third year

Q86: On April 18, 20X8, Robert sold his

Q87: Illuminating Light Partnership had the following revenues,

Q89: This year, Reggie's distributive share from Almonte

Q91: Jordan, Inc., Bird, Inc., Ewing, Inc., and

Q92: Lincoln, Inc., Washington, Inc., and Adams, Inc.

Q93: Alfred, a one-third profits and capital partner

Q121: Explain why partners must increase their tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents