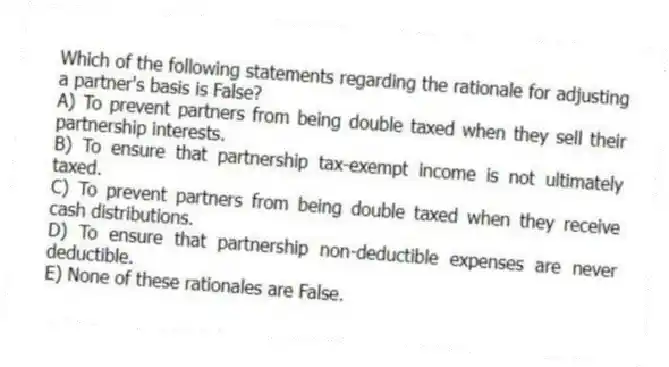

Which of the following statements regarding the rationale for adjusting a partner's basis is False?

A) To prevent partners from being double taxed when they sell their partnership interests.

B) To ensure that partnership tax-exempt income is not ultimately taxed.

C) To prevent partners from being double taxed when they receive cash distributions.

D) To ensure that partnership non-deductible expenses are never deductible.

E) None of these rationales are False.

Correct Answer:

Verified

Q64: In what order are the loss limitations

Q65: Which of the following statements regarding partnerships

Q66: Which of the following would not be

Q67: Which of the following items will affect

Q68: On January 1, X9, Gerald received his

Q70: Which person would generally be treated as

Q71: John, a limited partner of Candy Apple,

Q72: Styling Shoes, LLC filed its 20X8 Form

Q73: What is the difference between the aggregate

Q73: How does additional debt or relief of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents