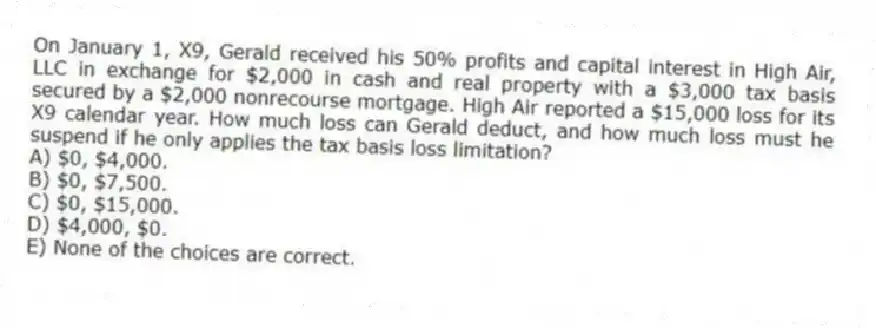

On January 1, X9, Gerald received his 50% profits and capital interest in High Air, LLC in exchange for $2,000 in cash and real property with a $3,000 tax basis secured by a $2,000 nonrecourse mortgage. High Air reported a $15,000 loss for its X9 calendar year. How much loss can Gerald deduct, and how much loss must he suspend if he only applies the tax basis loss limitation?

A) $0, $4,000.

B) $0, $7,500.

C) $0, $15,000.

D) $4,000, $0.

E) None of the choices are correct.

Correct Answer:

Verified

Q64: In what order are the loss limitations

Q65: Which of the following statements regarding partnerships

Q66: Which of the following would not be

Q67: Which of the following items will affect

Q69: Which of the following statements regarding the

Q70: Which person would generally be treated as

Q71: John, a limited partner of Candy Apple,

Q72: Styling Shoes, LLC filed its 20X8 Form

Q73: What is the difference between the aggregate

Q95: What type of debt is not included

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents