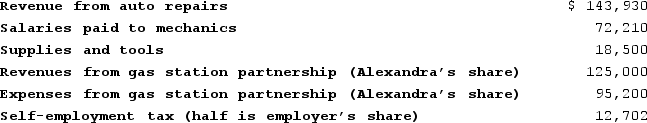

Alexandra operates a garage as a sole proprietorship. Alexandra also owns a half interest in a partnership that operates a gas station. This year Alexandra paid or reported the following expenses related to her garage and other property. Determine Alexandra's AGI for 2020.

Correct Answer:

Verified

All of the expenses ar...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Tita, a married taxpayer filing jointly, has

Q85: Chuck has AGI of $70,000 and has

Q86: This year Darcy made the following charitable

Q88: Alexandra operates a garage as a sole

Q89: This year, Benjamin Hassell paid $15,900 of

Q91: Kaylee is a self-employed investment counselor who

Q92: Kaylee is a self-employed investment counselor who

Q93: Jenna (age 50)files single and reports AGI

Q94: Scott is a self-employed plumber and his

Q95: Last year Henry borrowed $10,000 to help

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents