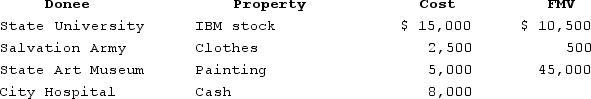

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museumin a manner consistent withthe museum's charitable purpose.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Chuck has AGI of $70,700 and has

Q84: Detmer is a successful doctor who earned

Q85: Chuck has AGI of $70,000 and has

Q85: Tita, a married taxpayer filing jointly, has

Q88: Alexandra operates a garage as a sole

Q89: This year, Benjamin Hassell paid $15,900 of

Q90: Alexandra operates a garage as a sole

Q91: Kaylee is a self-employed investment counselor who

Q93: Last year Henry borrowed $15,000 to help

Q97: This year Tiffanie files as a single

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents