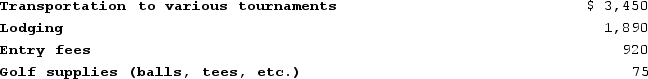

Detmer is a successful doctor who earned $204,800 in fees this year, but he also competes in weekend golf tournaments. Detmer reported the following expenses associated with competing in almost a dozen tournaments:

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Madeoff donated stock (capital gain property)to a

Q78: Larry recorded the following donations this year:

Q81: Chuck has AGI of $70,700 and has

Q85: Chuck has AGI of $70,000 and has

Q85: Tita, a married taxpayer filing jointly, has

Q86: This year Darcy made the following charitable

Q88: Alexandra operates a garage as a sole

Q89: This year, Benjamin Hassell paid $15,900 of

Q93: Last year Henry borrowed $15,000 to help

Q97: This year Tiffanie files as a single

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents