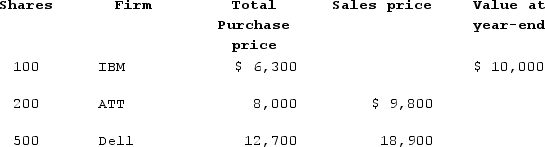

This year Ann has the following stock transactions. What amount is included in her gross income if Ann paid a $285 selling commission for each sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q128: J.Z. (single taxpayer)is retired and received $10,000

Q129: Charles purchased an annuity from an insurance

Q132: Kathryn is employed by Acme and they

Q135: Wendell is an executive with CFO Tires.

Q137: Aubrey and Justin file married filing separately.

Q141: Andres has received the following benefits this

Q143: Andres has received the following benefits this

Q145: Simon was awarded a scholarship to attend

Q145: Caroline is retired and receives income from

Q147: Teresa was married on November 1 of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents