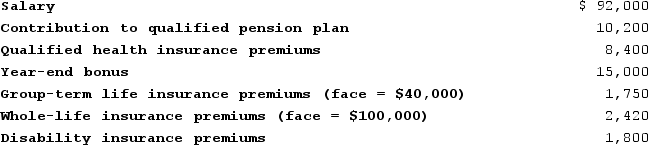

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q129: Charles purchased an annuity from an insurance

Q132: Kathryn is employed by Acme and they

Q135: Wendell is an executive with CFO Tires.

Q137: Aubrey and Justin file married filing separately.

Q140: This year Ann has the following stock

Q143: Andres has received the following benefits this

Q145: Simon was awarded a scholarship to attend

Q145: Caroline is retired and receives income from

Q147: Teresa was married on November 1 of

Q148: Lisa and Collin are married. Lisa works

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents