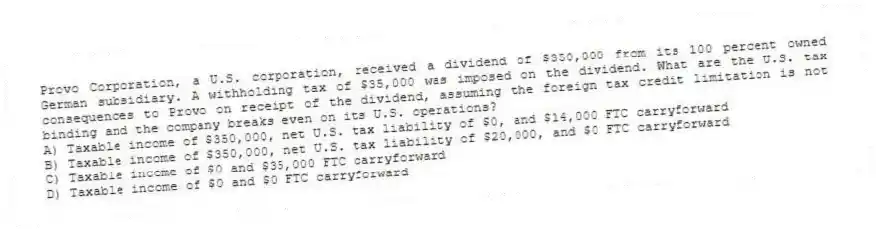

Provo Corporation, a U.S. corporation, received a dividend of $350,000 from its 100 percent owned German subsidiary. A withholding tax of $35,000 was imposed on the dividend. What are the U.S. tax consequences to Provo on receipt of the dividend, assuming the foreign tax credit limitation is not binding and the company breaks even on its U.S. operations?

A) Taxable income of $350,000, net U.S. tax liability of $0, and $14,000 FTC carryforward

B) Taxable income of $350,000, net U.S. tax liability of $20,000, and $0 FTC carryforward

C) Taxable income of $0 and $35,000 FTC carryforward

D) Taxable income of $0 and $0 FTC carryforward

Correct Answer:

Verified

Q50: Which of the following is not a

Q51: Bismarck Corporation has a precredit U.S. tax

Q53: Absent a treaty provision, what is the

Q54: Manchester Corporation, a U.S. corporation, incurred $100,000

Q56: Which of the following items of foreign

Q57: A U.S. corporation reports its foreign tax

Q57: Boca Corporation, a U.S. corporation, reported U.S.

Q58: Which of the following tax or non-tax

Q59: Horton Corporation is a 100 percent owned

Q60: Pierre Corporation has a precredit U.S. tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents