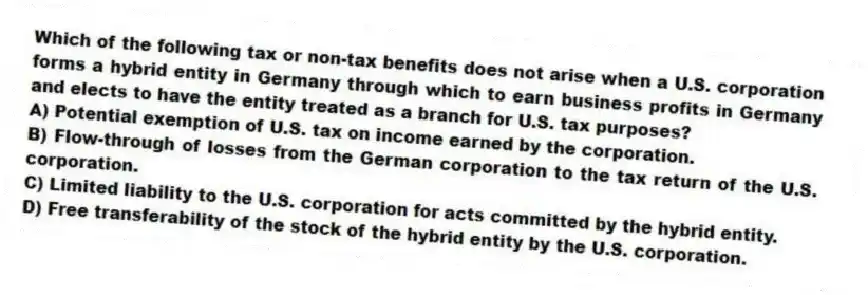

Which of the following tax or non-tax benefits does not arise when a U.S. corporation forms a hybrid entity in Germany through which to earn business profits in Germany and elects to have the entity treated as a branch for U.S. tax purposes?

A) Potential exemption of U.S. tax on income earned by the corporation.

B) Flow-through of losses from the German corporation to the tax return of the U.S. corporation.

C) Limited liability to the U.S. corporation for acts committed by the hybrid entity.

D) Free transferability of the stock of the hybrid entity by the U.S. corporation.

Correct Answer:

Verified

Q53: Absent a treaty provision, what is the

Q54: Manchester Corporation, a U.S. corporation, incurred $100,000

Q55: Provo Corporation, a U.S. corporation, received a

Q56: Which of the following items of foreign

Q57: Boca Corporation, a U.S. corporation, reported U.S.

Q59: Horton Corporation is a 100 percent owned

Q60: Pierre Corporation has a precredit U.S. tax

Q62: Which of the following statements best describes

Q63: Holmdel, Inc., a U.S. corporation, received the

Q69: A rectangle with an inverted triangle within

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents