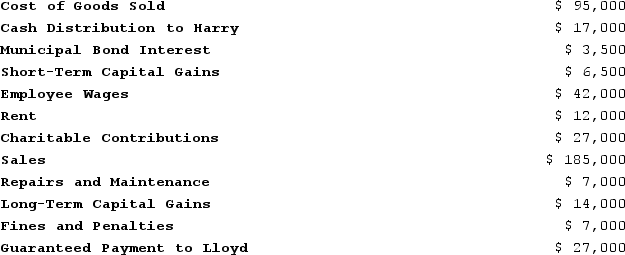

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: On April 18, 20X8, Robert sold his

Q89: John, a limited partner of Candy Apple,

Q98: On March 15, 20X9, Troy, Peter, and

Q103: Greg, a 40percent partner in GSS Partnership,

Q104: Ruby's tax basis in her partnership interest

Q105: Ruby's tax basis in her partnership interest

Q106: At the end of Year 1, Tony

Q112: This year, Reggie's distributive share from Almonte

Q121: Explain why partners must increase their tax

Q123: What is the difference between a partner's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents