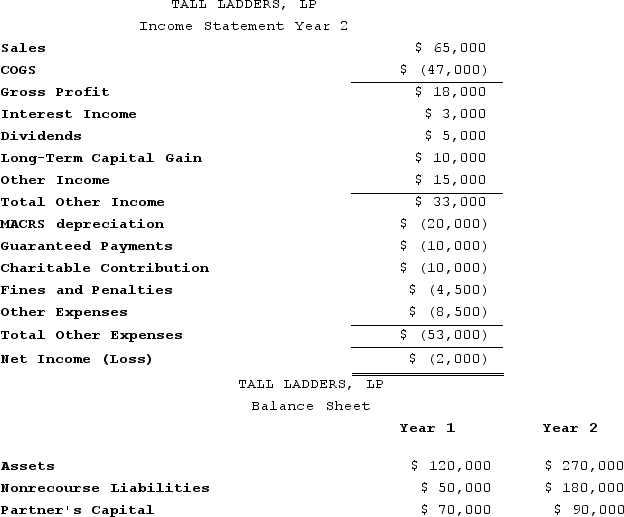

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Lloyd and Harry, equal partners, form the

Q103: Greg, a 40percent partner in GSS Partnership,

Q104: Ruby's tax basis in her partnership interest

Q105: Ruby's tax basis in her partnership interest

Q111: Ruby's tax basis in her partnership interest

Q112: This year, Reggie's distributive share from Almonte

Q119: Why are guaranteed payments deducted in calculating

Q121: Explain why partners must increase their tax

Q122: Bob is a general partner in Fresh

Q123: What is the difference between a partner's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents