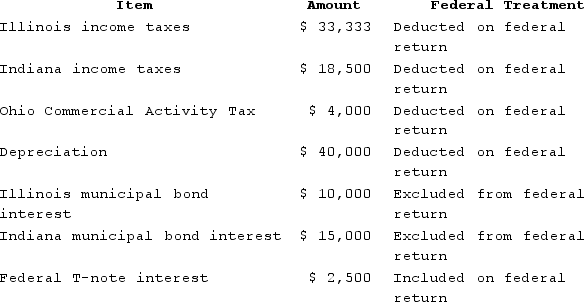

Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  State depreciation expense was $50,000. Hoosier's federal taxable income was $150,300. Calculate Hoosier's Indiana state tax base.

State depreciation expense was $50,000. Hoosier's federal taxable income was $150,300. Calculate Hoosier's Indiana state tax base.

A) $171,300

B) $173,800

C) $199,633

D) $207,133

Correct Answer:

Verified

Q81: What was the Supreme Court's holding in

Q88: Wacky Wendy produces gourmet cheese in Wisconsin.

Q90: Lefty provides demolition services in several southern

Q92: Hoosier Incorporated is an Indiana corporation. It

Q92: Which of the following is not a

Q94: Wacky Wendy produces gourmet cheese in Wisconsin.

Q96: Which of the following is not a

Q97: PWD Incorporated is an Illinois corporation. It

Q98: Handsome Rob provides transportation services in several

Q100: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents