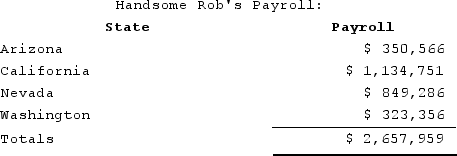

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob hasincome tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $201,800 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

A) $932,951.

B) $1,134,751.

C) $1,215,401.

D) $2,657,959.

Correct Answer:

Verified

Q81: What was the Supreme Court's holding in

Q87: Which of the following is not a

Q93: Hoosier Incorporated is an Indiana corporation. It

Q94: Wacky Wendy produces gourmet cheese in Wisconsin.

Q97: PWD Incorporated is an Illinois corporation. It

Q97: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q100: Which of the following is not a

Q124: Tennis Pro is headquartered in Virginia. Assume

Q134: Tennis Pro is headquartered in Virginia. Assume

Q136: Assume Tennis Pro discovered that one salesperson

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents