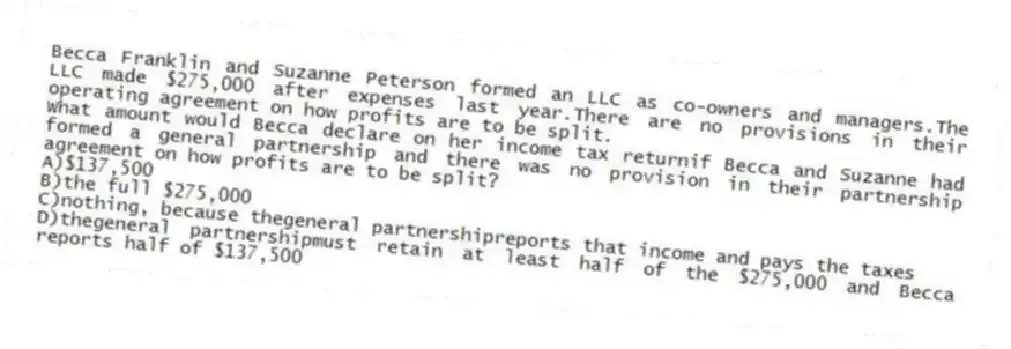

Becca Franklin and Suzanne Peterson formed an LLC as co-owners and managers.The LLC made $275,000 after expenses last year.There are no provisions in their operating agreement on how profits are to be split.

-What amount would Becca declare on her income tax returnif Becca and Suzanne had formed a general partnership and there was no provision in their partnership agreement on how profits are to be split?

A) $137,500

B) the full $275,000

C) nothing, because thegeneral partnershipreports that income and pays the taxes

D) thegeneral partnershipmust retain at least half of the $275,000 and Becca reports half of $137,500

Correct Answer:

Verified

Q127: Several retirement funds that own shares in

Q128: Which of the following forms of business

Q129: Grace Owen formed a corporation with three

Q130: Which of the following is a requirement

Q131: American Greetings,a family-owned corporation,wished to take the

Q133: Roche Holding and AstraZeneca have agreed to

Q134: A corporation is said to have double

Q135: Greg Knowles owns a business,Clean and Paint.Clean

Q136: Ann Archer purchased shares from XYZ Corp.for

Q137: Becca Franklin and Suzanne Peterson formed an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents