Becca Franklin and Suzanne Peterson formed an LLC as co-owners and managers.The LLC made $275,000 after expenses last year.There are no provisions in their operating agreement on how profits are to be split.

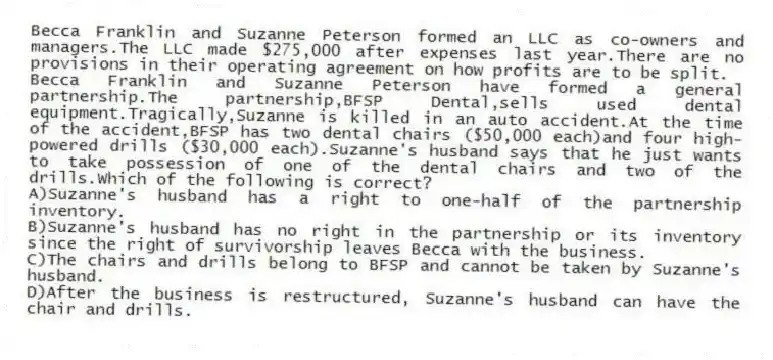

-Becca Franklin and Suzanne Peterson have formed a general partnership.The partnership,BFSP Dental,sells used dental equipment.Tragically,Suzanne is killed in an auto accident.At the time of the accident,BFSP has two dental chairs ($50,000 each) and four high-powered drills ($30,000 each) .Suzanne's husband says that he just wants to take possession of one of the dental chairs and two of the drills.Which of the following is correct?

A) Suzanne's husband has a right to one-half of the partnership inventory.

B) Suzanne's husband has no right in the partnership or its inventory since the right of survivorship leaves Becca with the business.

C) The chairs and drills belong to BFSP and cannot be taken by Suzanne's husband.

D) After the business is restructured, Suzanne's husband can have the chair and drills.

Correct Answer:

Verified

Q132: Becca Franklin and Suzanne Peterson formed an

Q133: Roche Holding and AstraZeneca have agreed to

Q134: A corporation is said to have double

Q135: Greg Knowles owns a business,Clean and Paint.Clean

Q136: Ann Archer purchased shares from XYZ Corp.for

Q138: The CEO of Citigroup announced a $8

Q139: John Bloomberg and Erick Ashman have been

Q140: Jim Braun has been a partner in

Q141: List the provisions of Sarbanes-Oxley that affect

Q142: Alan Freeman is in the process of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents