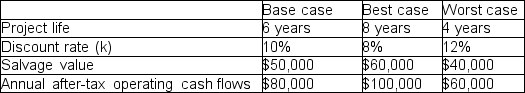

Delta Corporation is considering an investment of $400,000 in a new machine, which belongs to asset class 43 with a CCA rate of 30%.The machine is not the only asset in the asset class.The firm's effective tax rate is 40%.The company has the following estimates:

a)Determine the NPV for each scenario.

b)Would you recommend the company to undertake the project if each scenario is equally likely? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q117: A firm is considering launching a new

Q118: Explain how you would estimate the change

Q119: Explain the importance of scenario analysis in

Q120: A Bromont ski equipment manufacturer is thinking

Q121: HMS Corporation is considering an expansion project

Q122: A firm is considering purchasing a new

Q123: A firm is considering a project that

Q124: Abitibi Pulp Ltd.is considering a new

Q125: A firm is considering an investment of

Q126: BathGate Group has just completed its analysis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents