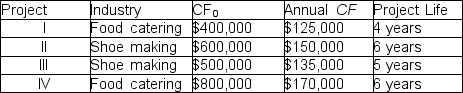

Fussy Inc.is composed of two different divisions: food catering and shoe making.The company's overall WACC is 10%, while the WACC for the food catering division is 9% and for the shoe making division is 12%.What would happen if the company used the overall WACC in the valuation of the following independent projects?

A) Incorrectly accept project III and incorrectly reject project IV

B) Incorrectly accept projects II and III

C) Incorrectly reject project I and incorrectly accept project III

D) Incorrectly reject projects I and IV

Correct Answer:

Verified

Q100: Use the following statements to answer this

Q101: Use the following statements to answer these

Q102: A firm has a budget constraint of

Q103: Capital rationing may be used as an

Q104: A firm has set a budget constraint

Q106: A firm has set a budget constraint

Q107: The profitability index can be useful in:

A)ranking

Q108: Toronto Skaters Corporation (TSC)has no budget constraint

Q109: A firm has set a budget constraint

Q110: If a firm uses a constant WACC

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents