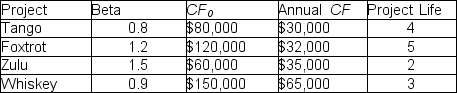

Toronto Skaters Corporation (TSC) has no budget constraint on new investments.The risk-free rate is 2% and the market risk premium is 6%.What rate of return (discount rate) should TSC use to evaluate the Zulu project?

A) 6.40%

B) 8.00%

C) 8.60%

D) 11.00%

Correct Answer:

Verified

Q103: Capital rationing may be used as an

Q104: A firm has set a budget constraint

Q105: Fussy Inc.is composed of two different divisions:

Q106: A firm has set a budget constraint

Q107: The profitability index can be useful in:

A)ranking

Q109: A firm has set a budget constraint

Q110: If a firm uses a constant WACC

Q111: A firm has a budget constraint of

Q112: Use the following two statements to answer

Q113: Thunder Bay Entertainment Inc.has two separate divisions:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents