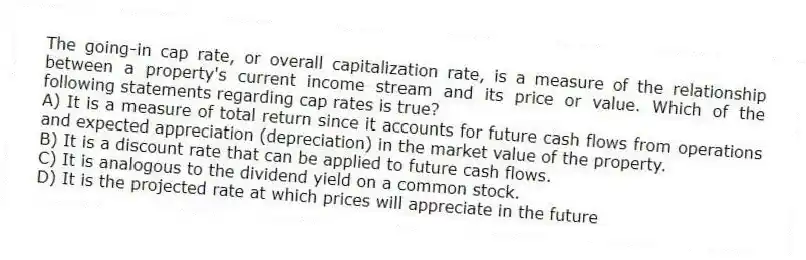

The going-in cap rate, or overall capitalization rate, is a measure of the relationship between a property's current income stream and its price or value. Which of the following statements regarding cap rates is true?

A) It is a measure of total return since it accounts for future cash flows from operations and expected appreciation (depreciation) in the market value of the property.

B) It is a discount rate that can be applied to future cash flows.

C) It is analogous to the dividend yield on a common stock.

D) It is the projected rate at which prices will appreciate in the future

Correct Answer:

Verified

Q2: Operating expenses can be divided into two

Q3: When using discounted cash flow analysis for

Q4: The cap rate is an important metric

Q5: Which of the following measures is considered

Q6: The distinction between market rent and contract

Q7: The starting point in calculating net operating

Q8: Given the following information, calculate the overall

Q9: The expected costs to make replacements, alterations,

Q10: For smaller income-producing properties, appraisers may use

Q11: Most appraisers adhere to an "above-line" treatment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents