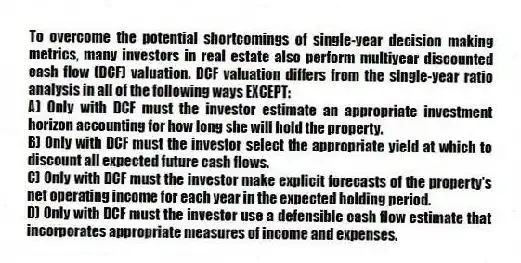

To overcome the potential shortcomings of single-year decision making metrics, many investors in real estate also perform multiyear discounted cash flow (DCF) valuation. DCF valuation differs from the single-year ratio analysis in all of the following ways EXCEPT:

A) Only with DCF must the investor estimate an appropriate investment horizon accounting for how long she will hold the property.

B) Only with DCF must the investor select the appropriate yield at which to discount all expected future cash flows.

C) Only with DCF must the investor make explicit forecasts of the property's net operating income for each year in the expected holding period.

D) Only with DCF must the investor use a defensible cash flow estimate that incorporates appropriate measures of income and expenses.

Correct Answer:

Verified

Q9: Given the following information, calculate the appropriate

Q10: Changes in the discount rate used to

Q11: In discounted cash flow analysis, the industry

Q12: Given the following information, calculate the going-out

Q13: The use of financial leverage when investing

Q15: It is common for investors in real

Q16: While net present value (NPV) and internal

Q17: Given the following information, calculate the NPV

Q18: The internal rate of return (IRR) on

Q19: The use of financial leverage in purchasing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents