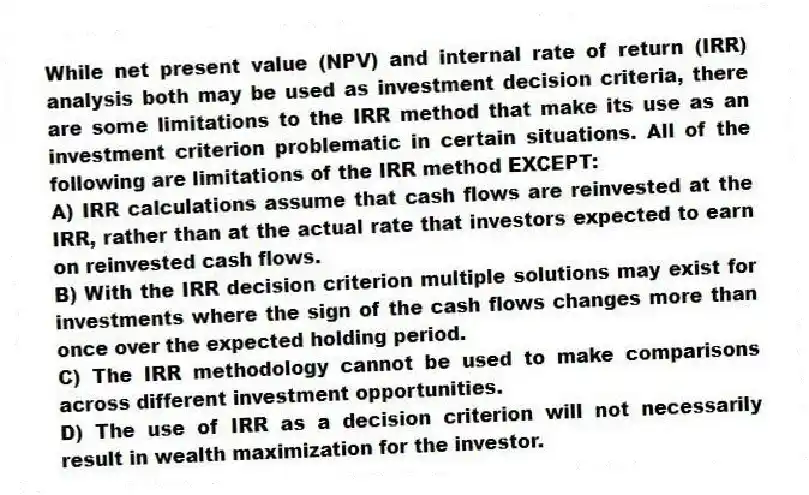

While net present value (NPV) and internal rate of return (IRR) analysis both may be used as investment decision criteria, there are some limitations to the IRR method that make its use as an investment criterion problematic in certain situations. All of the following are limitations of the IRR method EXCEPT:

A) IRR calculations assume that cash flows are reinvested at the IRR, rather than at the actual rate that investors expected to earn on reinvested cash flows.

B) With the IRR decision criterion multiple solutions may exist for investments where the sign of the cash flows changes more than once over the expected holding period.

C) The IRR methodology cannot be used to make comparisons across different investment opportunities.

D) The use of IRR as a decision criterion will not necessarily result in wealth maximization for the investor.

Correct Answer:

Verified

Q11: In discounted cash flow analysis, the industry

Q12: Given the following information, calculate the going-out

Q13: The use of financial leverage when investing

Q14: To overcome the potential shortcomings of single-year

Q15: It is common for investors in real

Q17: Given the following information, calculate the NPV

Q18: The internal rate of return (IRR) on

Q19: The use of financial leverage in purchasing

Q20: Based on your understanding of the differences

Q21: A client has requested advice on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents