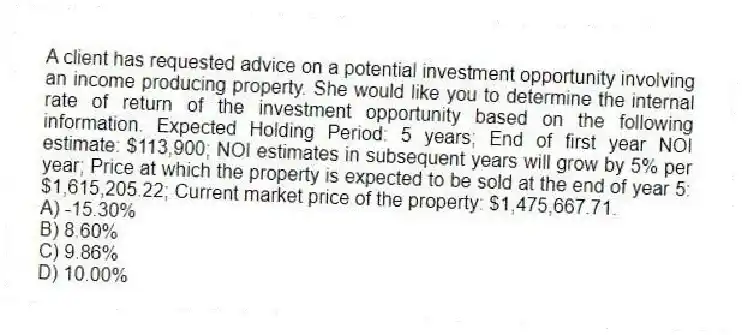

A client has requested advice on a potential investment opportunity involving an income producing property. She would like you to determine the internal rate of return of the investment opportunity based on the following information. Expected Holding Period: 5 years; End of first year NOI estimate: $113,900; NOI estimates in subsequent years will grow by 5% per year; Price at which the property is expected to be sold at the end of year 5: $1,615,205.22; Current market price of the property: $1,475,667.71.

A) -15.30%

B) 8.60%

C) 9.86%

D) 10.00%

Correct Answer:

Verified

Q16: While net present value (NPV) and internal

Q17: Given the following information, calculate the NPV

Q18: The internal rate of return (IRR) on

Q19: The use of financial leverage in purchasing

Q20: Based on your understanding of the differences

Q22: Given the following information regarding an income

Q23: Suppose an industrial building can be purchased

Q24: Determine the net present value (NPV) of

Q25: Given the following information regarding an income

Q26: Given the following expected cash flow stream,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents