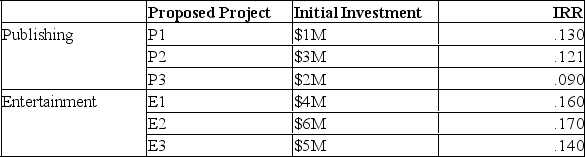

Eyes of the World Corporation has traditionally employed a firm wide discount rate for capital budgeting purposes. However, its two divisions - publishing and entertainment - have different degrees of risk given by P = 1.0, E = 2.0, and the beta for the overall firm is 1.3. The firm is considering the following capital expenditures:

Which projects would the firm accept if it uses the opportunity cost of capital for the entire company? Which projects would it accept if it estimates cost of capital separately for each division? Use 6% as the risk-free rate, and 12% as the expected return on the market.

Which projects would the firm accept if it uses the opportunity cost of capital for the entire company? Which projects would it accept if it estimates cost of capital separately for each division? Use 6% as the risk-free rate, and 12% as the expected return on the market.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Peter's Audio Shop has a cost of

Q54: One Caveat of using EVA as a

Q55: Jack's Construction Co. has 80,000 bonds outstanding

Q56: The current market rate of return is

Q58: The current market rate of return is

Q59: The Tenplen Corporation has an equity beta

Q60: The current market rate of return is

Q61: Given the sample of returns of the

Q62: On-line Text Co. has four new

Q188: Jake's Sound Systems has 210,000 shares of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents