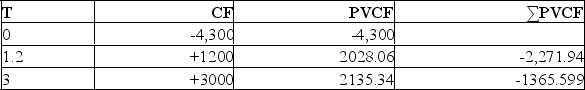

The Ziggy Trim and Cut Company can purchase equipment on sale for $4,300. The asset has a three-year life, will produce a cashflow of $1,200 in the first and second year, and $3,000 in the third year. The interest rate is 12%. Calculate the project's discounted payback and Profitability Index assuming end of year cash flows. Should the project be taken? If the accounting rate of return was positive, how would this affect your decision?

Correct Answer:

Verified

PI ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: The Ziggy Trim and Cut Company can

Q48: The Walker Landscaping Company can purchase a

Q49: The Walker Landscaping Company can purchase a

Q50: Suppose that a project has a cash

Q52: Given the cash flow stream of the

Q53: Suppose that a project has a cash

Q54: The NPV rule and PI give the

Q55: You are considering a project with the

Q55: Cutler Compacts will generate cash flows of

Q92: Given the goal of maximization of firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents