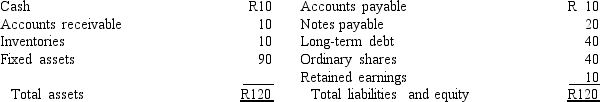

A firm has the following statement of financial position:  Fixed assets are being used at 80 percent of capacity; sales for the year just ended were R200; sales will increase R10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?

Fixed assets are being used at 80 percent of capacity; sales for the year just ended were R200; sales will increase R10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?

A) R4.00

B) R2.00

C) -R0.80 (Surplus)

D) -R14.00 (Surplus)

E) R0

Correct Answer:

Verified

Q3: If a firm's degree of total leverage

Q9: Considering each action independently and holding other

Q18: The degree of operating leverage has which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents