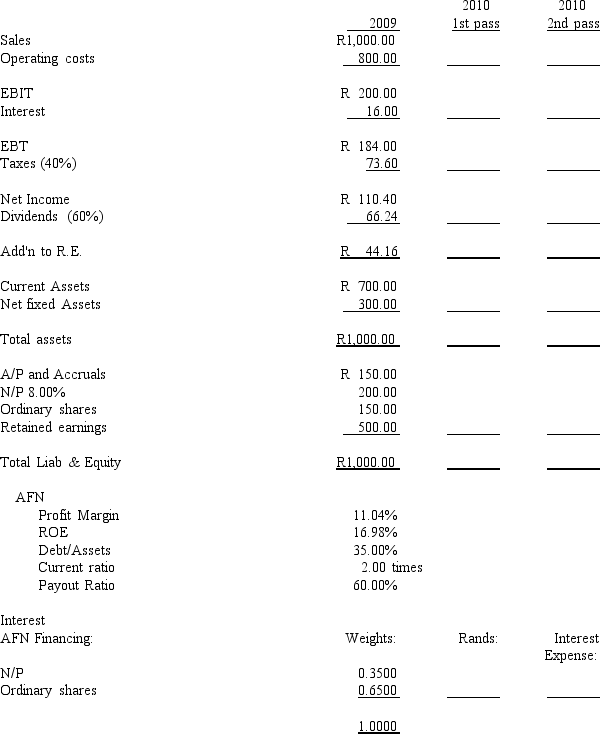

Information on the Crum Company:

-Hogan Inc.generated EBIT of R240,000 this past year using assets of R1,100,000.The interest rate on its existing long-term debt of R640,000 is 12.5 percent and the firm's tax rate is 40 percent.The firm paid a dividend of R1.27 on each of its 37,800 shares outstanding from net income of R96,000.The total book value of equity is R446,364 of which the ordinary shares account equals R335,000.The firm's shares sell for R28.00 per share in the market.The firm forecasts a 10% increase in sales, assets, and EBIT next year, and a dividend of R1.40 per share.If the firm needs additional capital funds, it will raise 60% with debt and 40% with equity.The cost of any new debt will be 13%.Spontaneous liabilities are estimated at R15,000 for next year, representing an increase of 10% over this year.Except for spontaneous liabilities, the firm uses no other sources of current liabilities and will continue this policy in the future.What will be the cumulative AFN Hogan will need to balance its projected statement of financial position using the projected statement of financial position method through the first two passes?

A) R5,013

B) R3,417

C) R51,156

D) R26,228

E) R54,573

Correct Answer:

Verified

Q26: Q36: Q52: Q77: A firm has the following statement of Q78: You are the owner of a small Q79: By definition, a firm's financial breakeven point Q80: Expert Analysts Resources (EAR) has provided you Q83: Martin Corporation currently sells 180,000 units per Q84: Stellenbosch Vineyards is considering two alternative production Q87: Information on the Crum Company: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()