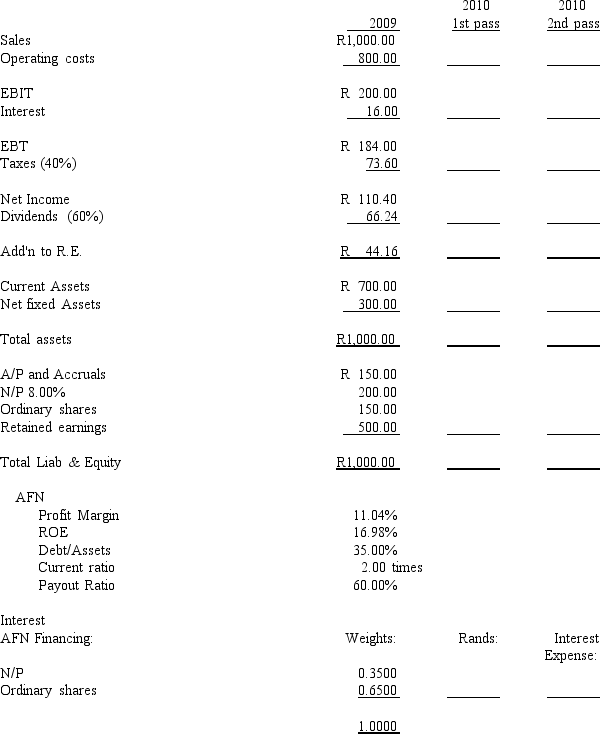

Information on the Crum Company:

-Refer to Crum Company.Crum expects sales to grow by 50% in 2010, and operating costs should increase at the same rate.Fixed assets were being operated at 40% of capacity in 2009, but all other assets were used to full capacity.Underutilised fixed assets cannot be sold.Current assets and spontaneous liabilities should increase at the same rate as sales during 2010.The company plans to finance any external funds needed as 35% notes payable and 65% ordinary shares.After taking financing feedbacks into account, and after the second pass, what is Crum's projected ROE using the projected statement of financial position method?

A) 16.98%

B) 23.73%

C) 25.68%

D) 19.61%

E) 23.24%

Correct Answer:

Verified

Q26: Q36: Q52: Q59: Q82: Information on the Crum Company: Q83: Martin Corporation currently sells 180,000 units per Q84: Stellenbosch Vineyards is considering two alternative production Q88: Musgrave Corporation has fixed operating costs of Q90: Trident Food Corporation Q91: Marcus Corporation currently sells 150,000 units a Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()

Trident Food Corporation generated the