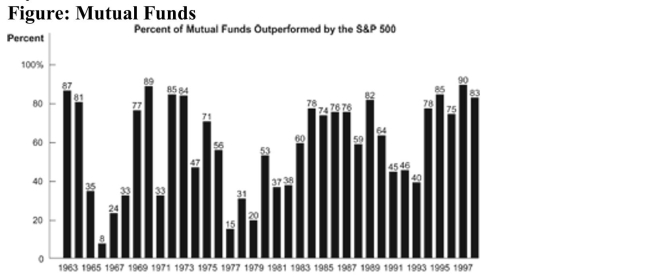

(Figure: Mutual Funds) Refer to the figure. From this MutualFunds figure, John Stossel dart-throwing experiment we cansay that:

A) mutual funds typically outperform the S&P 500.

B) mutual fund managers are no smarter than monkeys.

C) knowledge of stock market behavior does not guarantee its predictability.

D) mutual funds can never outperform the stock market.

Correct Answer:

Verified

Q4: John Stossel's dart-throwing experiment showed that:

A) picking

Q16: Suppose 1,000 experts flip a coin once

Q17: In a market of 2,000 investors who

Q19: John Stossel picked Wall Street stocks at

Q28: Which of the following are advantages of

Q35: Which of the following is TRUE of

Q46: If another unit of Good X gives

Q49: The major difference between active and passive

Q131: The utility-maximizing consumption bundle for a consumer

Q132: Indifference curves can never cross.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents