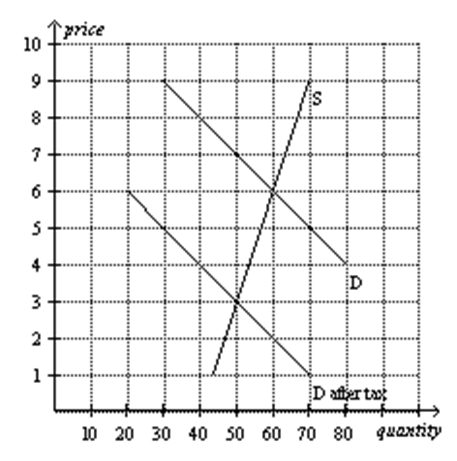

Using the graph below, answer the following questions:

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Correct Answer:

Verified

b. R4

c. R1

d. R3

e. R7

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: A tax placed on a good that

Q41: What is the difference between a price

Q45: Subsidies are levied when a government wants

Q46: Using the graph below, answer the following

Q47: Using the graph shown (below), analyze the

Q47: Why would policymakers choose to impose a

Q49: A subsidy is the opposite of a

Q54: For which of the following products would

Q55: Using the graph below, in which the

Q192: Which of the following is correct? A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents