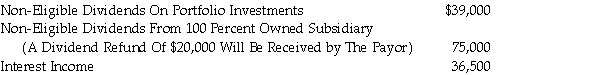

One of your clients has asked your advice on whether she should transfer a group of investments to a new corporation that can be established to hold them. The corporation will be a Canadian controlled private corporation and she anticipates that the transferred investments will have the following amounts of income for the year ending December 31, 2020:  Your client has business income of over $250,000. She needs all of the income that is produced by these investments to purchase art for her cherished collection. On additional amounts, your client is subject to a provincial tax rate of 18 percent.

Your client has business income of over $250,000. She needs all of the income that is produced by these investments to purchase art for her cherished collection. On additional amounts, your client is subject to a provincial tax rate of 18 percent.

In her province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 12 percent on other income

• the dividend tax credit is 25 percent of the dividend gross up for non-eligible dividends

Provide the requested advice, including an explanation of your conclusions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Cloister Inc. is a Canadian controlled private

Q65: Victor Vice is a very conservative investor

Q66: Maximilian Maximus has employment income in excess

Q67: Which of the following types of owner-manager

Q68: Ms. Shauna MacDonald has investments that she

Q70: Sharon Hartly is the owner-manager of a

Q71: Joan Barts owns all of the outstanding

Q72: Jonathan Baxter owns all of the shares

Q73: Larry Watts, a Canadian resident, owns 49

Q74: On January 1, 2020, Saul Barkin owns

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents