Maximilian Maximus has employment income in excess of $300,000. This means that any additional income will be taxed at a combined federal/provincial rate of 51 percent.

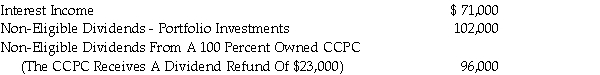

For the year ending December 31, 2020, in addition to his employment income, Max has the following amounts of investment income:  Because of his extensive use of recreational drugs, Max requires all of the income that is produced by these investments (and then some).

Because of his extensive use of recreational drugs, Max requires all of the income that is produced by these investments (and then some).

In his province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 12 percent on other income

• the dividend tax credit is 4/13 percent of the dividend gross up for non-eligible dividends

Max has asked your advice as to whether there would be any tax benefits associated with transferring his investments to a corporation. Provide the requested advice, including an explanation of your conclusions.

Correct Answer:

Verified

If the income i...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Lisgar Ltd. is a CCPC with a

Q62: Martin Locks owns 100 percent of the

Q63: Wanda Ho has employment income in excess

Q64: Cloister Inc. is a Canadian controlled private

Q65: Victor Vice is a very conservative investor

Q67: Which of the following types of owner-manager

Q68: Ms. Shauna MacDonald has investments that she

Q69: One of your clients has asked your

Q70: Sharon Hartly is the owner-manager of a

Q71: Joan Barts owns all of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents