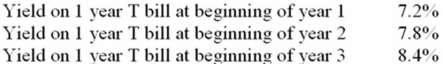

Using the expectations hypothesis for the term structure of interest rates, calculate the expected yields for securities with maturities of two and three years on the basis of the following data:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Level production methods smooth production schedules and

Q26: The ratio of long-term financing to short-term

Q107: Explain why long-term financing is more expensive

Q109: Three basic theories describe the term structure

Q111: What is the cash conversion cycle? What

Q112: A normal yield curve is downward sloping

Q117: Liquidity premium theory states that securities are

Q121: Christensen & Assoc.is developing an asset financing

Q122: McKinsee Inc.is developing a plan to finance

Q123: King, Inc., a successful Midwest firm, is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents