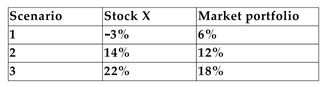

The possible outcomes for the returns on Stock X and the returns on the market portfolio have been estimated as follows:  Each scenario is considered to be equally likely to occur.

Each scenario is considered to be equally likely to occur.

-Refer to the information above. Calculate the covariance of the returns of Stock X and the market portfolio.

A) 12.2%%

B) 150.0%%

C) 61.7%%

D) 50.0%%

Correct Answer:

Verified

Q19: The following equally likely outcomes have been

Q20: A mutual fund has five equally likely

Q21: When computing a market beta using historical

Q22: The following information has been estimated for

Q23: Portfolio R offers an expected return of

Q25: Assume investors hold the market portfolio. Rank

Q26: Assume you hold the market portfolio. Which

Q27: You have analyzed four stocks and obtained

Q28: You have analyzed four stocks and obtained

Q29: The possible outcomes for the returns on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents