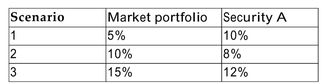

The following information has been estimated for the returns on the market portfolio

and the returns on Security A:  The three scenarios are considered equally likely to occur. Calculate the market beta of

The three scenarios are considered equally likely to occur. Calculate the market beta of

Security A.

Correct Answer:

Verified

Q17: The following returns have been estimated for

Q18: Which of the following is (are)a measure(s)of

Q19: The following equally likely outcomes have been

Q20: A mutual fund has five equally likely

Q21: When computing a market beta using historical

Q23: Portfolio R offers an expected return of

Q24: The possible outcomes for the returns on

Q25: Assume investors hold the market portfolio. Rank

Q26: Assume you hold the market portfolio. Which

Q27: You have analyzed four stocks and obtained

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents