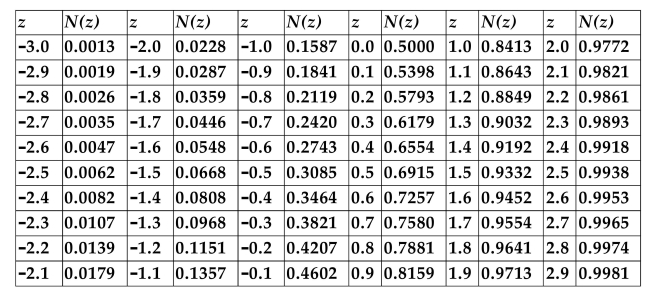

CUMULATIVE NORMAL DISTRIBUTION TABLE

-Refer to the information above. A stock is currently selling for $42. The stock pays no dividends. An American call option on the stock has a strike price of $45 and has 6 months to

Expiration. The standard deviation of the continuously compounded rate of return of the stock

Is 25%, and the annualized risk-free rate is 3%. Use the Black-Scholes formula to calculate the

Fair value of this option.

A) $2.33

B) $2.01

C) $2.25

D) The Black-Scholes formula cannot be used to determine the fair value of an American call option.

Correct Answer:

Verified

Q32: CUMULATIVE NORMAL DISTRIBUTION TABLE Q33: The value of the right to exercise Q34: What is the difference between writing a Q35: A European call option on a stock Q36: Which of the following values can not Q38: Using 5 years of historical daily stock Q39: A European put option on a certain Q40: A call option with 6 months to Q41: Inmar Corporation is a mail-order company that Q42: The change in the price of the![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents