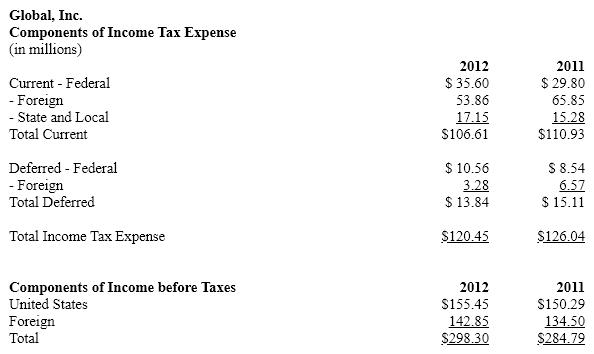

Global, Inc. provides consulting services throughout the world. The company pays taxes to the nation where revenues are earned. Information about the company's taxes is presented below:

a. Using the information provided for Global, prepare the company's journal entry to record income taxes for 2012 and 2011.

b. Using the information provided for Global, determine the company's effective tax rate for 2012 and 2011.

Correct Answer:

Verified

Q42: Accountants use reserve accounts for various reasons,for

Q47: A contractor would not use _ method

Q50: A company that uses LIFO will find

Q61: Assume that Madison Corp. has agreed to

Q67: Pronto, Inc. is a major producer of

Q68: Under U.S.GAAP,application of the LIFO and FIFO

Q69: What are the four disclosures required by

Q73: What are the five steps to apply

Q76: A company may try to paint a

Q78: Explain the difference between a temporary and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents