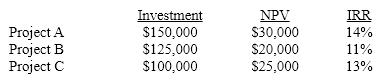

A firm has the following investment opportunities:  If the cost of capital is 10% and the capital budget is limited to $280,000, which project(s) should the firm undertake?

If the cost of capital is 10% and the capital budget is limited to $280,000, which project(s) should the firm undertake?

A) Project A and project B

B) Project A and project C

C) Project B and project C

D) Project A

Correct Answer:

Verified

Q59: A firm's financial managers have been asked

Q60: The net present value (NPV)method assumes that

Q61: _ involves selecting projects subject to a

Q62: Capital rationing may:

A)require omitting projects with higher

Q63: A project has the following cash flows:

Q65: A firm has the following investment opportunities:

Q66: Atlantis Inc. is considering two mutually exclusive

Q67: Sentry Oil Inc. is considering two mutually

Q68: An investment project requires an initial outlay

Q69: Sigma is thinking about purchasing a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents