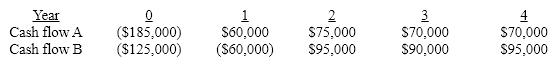

Sentry Oil Inc. is considering two mutually exclusive projects as follows: Sentry's a cost of capital is 14%. It can spend no more than $350,000 on capital projects this year, which of the following statements is applicable when evaluating the projects by the NPV method?

A) Both projects add shareholder wealth and should be undertaken.

B) Project B appears to add more shareholder wealth than project A and should be done.

C) Project A appears to add more shareholder wealth than project B and should be done.

D) Project B should be undertaken because it requires a smaller investment.

Correct Answer:

Verified

Q62: Capital rationing may:

A)require omitting projects with higher

Q63: A project has the following cash flows:

Q64: A firm has the following investment opportunities:

Q65: A firm has the following investment opportunities:

Q66: Atlantis Inc. is considering two mutually exclusive

Q68: An investment project requires an initial outlay

Q69: Sigma is thinking about purchasing a new

Q70: What is the net present value of

Q71: Assume the following facts about a firm's

Q72: Calculate the profitability index for a project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents